We take the hypothesis of a property that was built more than 5 years ago.

I The various taxes related to the acquisition of the property :

When acquiring the property, it’s necessary to pay transfer fees: The amount of the fees (notary fees and stamp duties) is divided into several fees collected by the State and the various local authorities of the place of establishment of the property.

a) Stamp duties The rates are as follows.

- A departmental tax at the rate of 3.80% on the purchase price, which was raised to 4.50% on the purchase price by almost all the General Councils. For department 06 (Alpes-Maritimes) the rate is 4.50%

- A communal tax at the rate of 1.20% on the purchase price.

- A levy for the benefit of the State at a rate of 2.37% which applies to the amount of the departmental tax.

An overall rate of 5.80%

To these expenses is added the property security contribution, as defined in article 879 of the CGI. The applicable rate is 0.10%

b) Notary fees

In addition it will be necessary to add the notary’s fees to these. Approximately 1%.

These rates are due regardless of whether he buys this property from an individual or a professional. (Note however that a professional who sells him this property may opt for the regime of the acquisition of a new property, that is to say a property having been built less than 5 years ago or whose work that has been carried out on the property is considered fiscally as making the property in new condition. This case being much less often applied we will remain on our first hypothesis.

When exceptional property located in the south of France is acquired, the owner is subject to:

- The property tax, this tax is established once a year and for the entire year and is calculated according to the situation on January 1 of the tax year.

- The calculation of this tax is established as follows: The administration calculates the cadastral income by applying a standard 50% bargain to the cadastral rental value.

- The property tax is equal to the cadastral income multiplied by the rates fixed by the local authorities. These rates may be modified from one year to the next.

To get an idea of the price to pay, it’s possibile to contact the property tax department to obtain an estimate of the property tax.

In addition to having to pay the property tax, it will be necessary to pay :

- A housing tax, then concerning second homes the regime varies. This tax is also calculated on January 1 of the tax year, it is due for the entire year.

This tax is calculated by the French tax authorities which is based on the cadastral rental value of the dwelling and its outbuildings.

Since this is a secondary residence, the owner can not benefit from the allowances and ceiling based on income.

Moreover, if the property is located in a municipality where the tax on vacant housing applies.

It’s possible to have an increase established by the cities going from 5% to 60% for the share of contribution of tax of house which they are entitled and that for the housing fulfilling the 2 following conditions:

- If the furnished accommodation is taxable to the housing tax,

- If the dwelling is not assigned to the main dwelling.

In addition to the housing tax, the owner has to pay at the same time the public audiovisual contribution if he has one or more televisions.

For information some municipalities, provides a fee or additional fee for the collection of household waste.

II- How to acquire the property ?

At each acquisition of real estate we can not advise you too much to acquire this property through a French company, called SCI “Société civile immobilière.” This society is a civil society is an incredible tool for wealth management and it is very useful in case of inheritance, this one avoids the indivision on the property.

If a personn buys a property through an SCI and that it is to income tax, she will have many advantages:

- Such as the reduction of the various expenses relating to a building whose income is taxable in the category of the property income. (This is not possible for vacant buildings). Another condition: the deducted expenses must have been taken for the acquisition or preservation of an income, they must have been paid by the taxpayer and they must have occurred during the tax year and always be

- Under certain conditions it is possible to deduce the expenses of maintenance and repair, serving to maintain the property in the state.

- It is possible to deduce improvement expenses if these expenses do not change the structure of the property.

- Administrative and management expenses are also deductible (ex: security guard, supervisory agent, accountant’s fees which deals with the management of the property). This point is not particularly interesting it’s just 20 euros by local.

It is possible to deduce the property tax, which is one of the big advantages of the SCI subjected to the income tax! However, the owner will still have to pay the fee or the tax for household waste. It is possible to deduce the loan interest! So if the owner buy the property through a loan, the interest on this loan that he have to pay will be deductible from his property income and that is not possible if he buys the property directly.

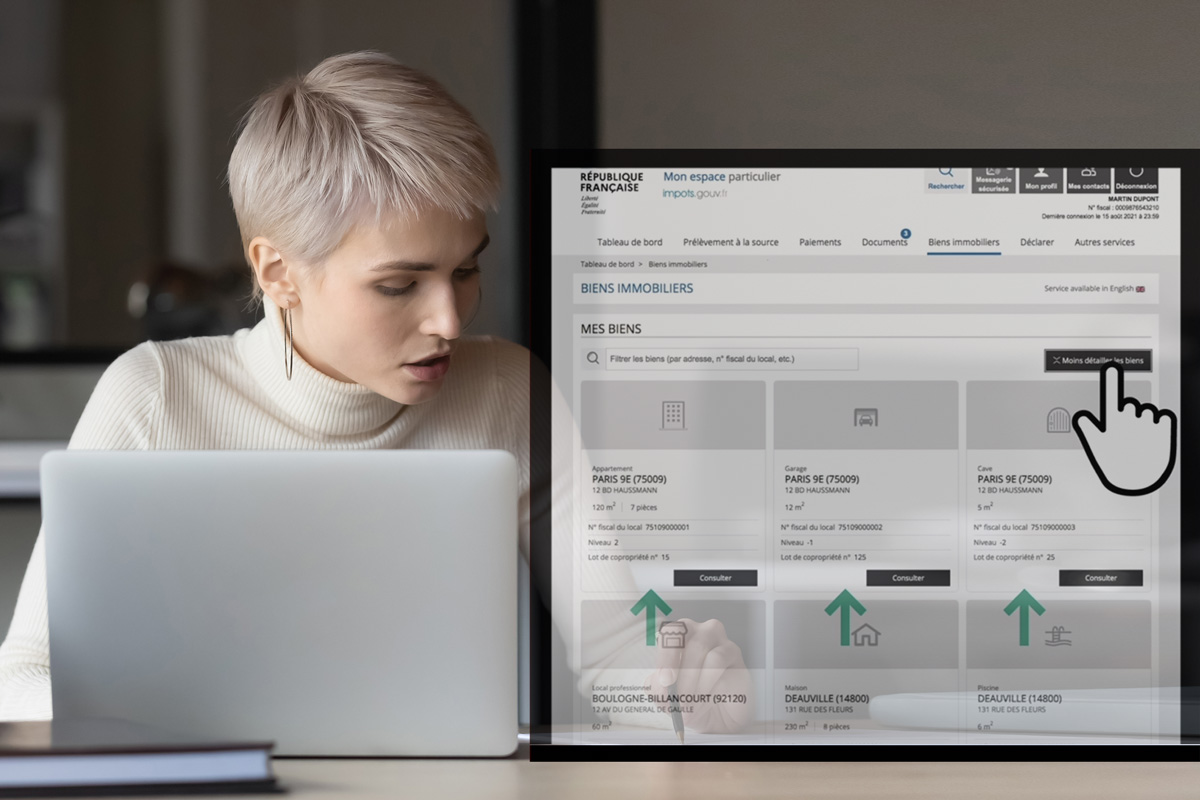

Please note that real estate owned in France directly or indirectly through a legal entity may be subject to taxation, whose amount is equal to 3% of the market value of the property, There are, however, a certain number of provisions which make it possible not to have to pay this tax in particular, the fact of communicating to the tax authorities “FTA”(at his request) a lot of information, this commitment must be made every year. Particulary, the commitment to disclose the name of the final beneficiary of the property.

It remains a tax and not least to consider : the IFI “Impôt sur la Fortune Immobilière”, the Tax on real estate, it replaces the ISF “Impôt Solidarité sur la Fortune” from January 2018.

It should be noted that non-residents will be subject to the IFI because of the property and rights they own (directly or indirectly) in France, we are not going to make a development on the IFI but know that if his net taxable wealth is greater than 1.3 million, he will be subject to it. Please note it is possible to deduct a lot of debts to reduce the taxable amount.(EX: certain debts contracted for the acquisition of property in France, taxes equivalent to the IFI paid abroad for the amount of the IFI paid for real estate assets located outside France, property tax …)

For large heritage note that when the market value of taxable wealth is greater than 5 million euros and that the amount of the debts exceeds 60% of this value, the portion of the debts exceeding this limit is only deductible for 50% of this excess.