The tax administration has just published a most important piece of information on its “public service” website, on 26th January 2023, in which it states that all owners will be subject to a new reporting obligation from the year 2023.

This new declaration concerning owners of real estate (for residential use) in France, must be made between 1st January and 30th June 2023.

It will concern both owners who are natural persons and owners who are legal entities.

This declaration is mandatory, its failure may be sanctioned by the application of a tax fine whose amount will be 150.00 euros per local. It should also be noted that omissions, errors or simply the fact of transmitting an incomplete declaration could also be subject to the aforementioned tax fine. However, we hope that in the event of submission of an incomplete declaration or containing some errors, the tax administration will show benevolence towards taxpayers in good faith, as provided for by the ESSOC Law (law for a State at the service of a trusted company) dated 10th August 10, 2018.

Before explaining how to make this declaration online (for natural persons and legal entities), let’s go back to the origin of this new tax declaration.

In recent years, a progressive reduction of the housing tax for principal residences has been put in place (Article 1414 of the General Tax Code). In 2023, all occupants of their main residence in France will be exempt from housing tax and this without conditions related to the amount of income received.

Obviously, this removal poses difficulties for the tax administration who must determine whether the dwelling owned as a dwelling is: a primary, secondary residence or used for rental purposes. To overcome this difficulty, the tax administration asks property owners to complete this new online declaration to find out if the property is a primary, secondary or rental residence.

How to make this declaration when you are a natural person who owns a residential property in France?

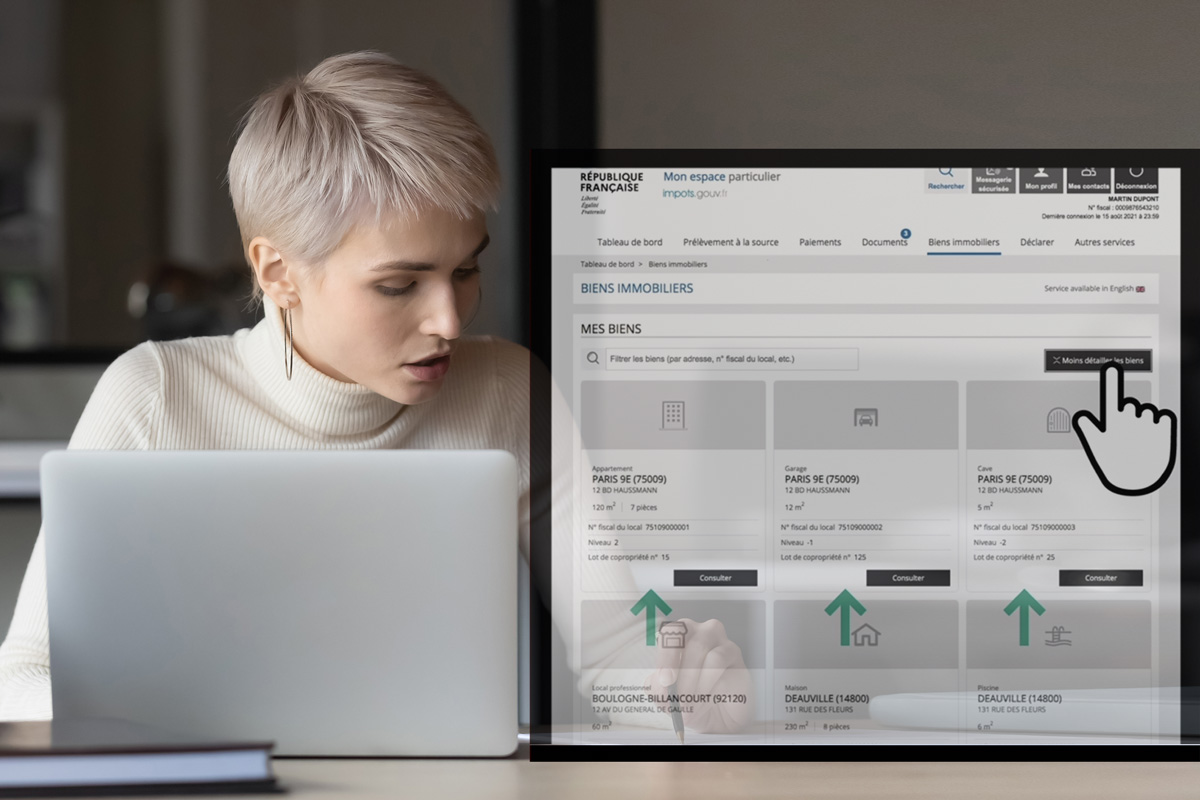

First, you must connect to your personal space “impot.gouv” with your identifiers (tax number and your password). Be careful, if you have not yet created your personal tax space on the impot.gouv website, you will have to do it!

Once connected, the dashboard appears, you have different tabs, you have to click on “real estate”, once you have clicked you have a list of your real estate that appears, there may be one or more (if you own several properties). You then click on “declaration of occupancy”, you have a new page that appears, it will be indicated the situation of your property (for example: this property is occupied by Mrs. Dupont), if the information is correct, you validate this by clicking on: “no change”, if this is incorrect, you click on “new situation”, a new page will appear and you will just have to indicate the requested information and validate this at the end.

How to make this declaration when you are a legal person owning a residential property in France?

First, you must connect to your professional space “impot.gouv” with your identifiers (email and your password). Be careful, if you have not yet created your professional tax space on the impot.gouv website for your company, you will have to do it too!

Please note that if on your professional space, you have several companies concerned by this reporting obligation, it will be necessary to do so for each company.

So, once on the professional space of your company, on the main dashboard, you have a tab “approach”, which contains a tab “manage my real estate”, you click on it and you will have access to the list of your assets, again it will be necessary as for natural persons to fill out these declarations online.

Attention, it is possible that by clicking on the tab “manage my real estate”, the following message appears: “No property was found. Only built properties for which you hold a right of ownership are displayed in this service. ».

In these cases, do not hesitate to inform the tax authorities, via the messaging tab on your professional space impot.gouv.

Note that if you have not subscribed to this online service, you will have to do so through the service “subscribe to the online service” and you will have to tick: “manage my real estate”, you will receive a confirmation email and then a letter containing the activation codes of this service to the address of the headquarters of the entity.

If you have any doubts about this new reporting obligation, do not hesitate to consult your counsel.

The Floyd Avocats team is at your disposal to assist you in your efforts.