French income tax for non-residents

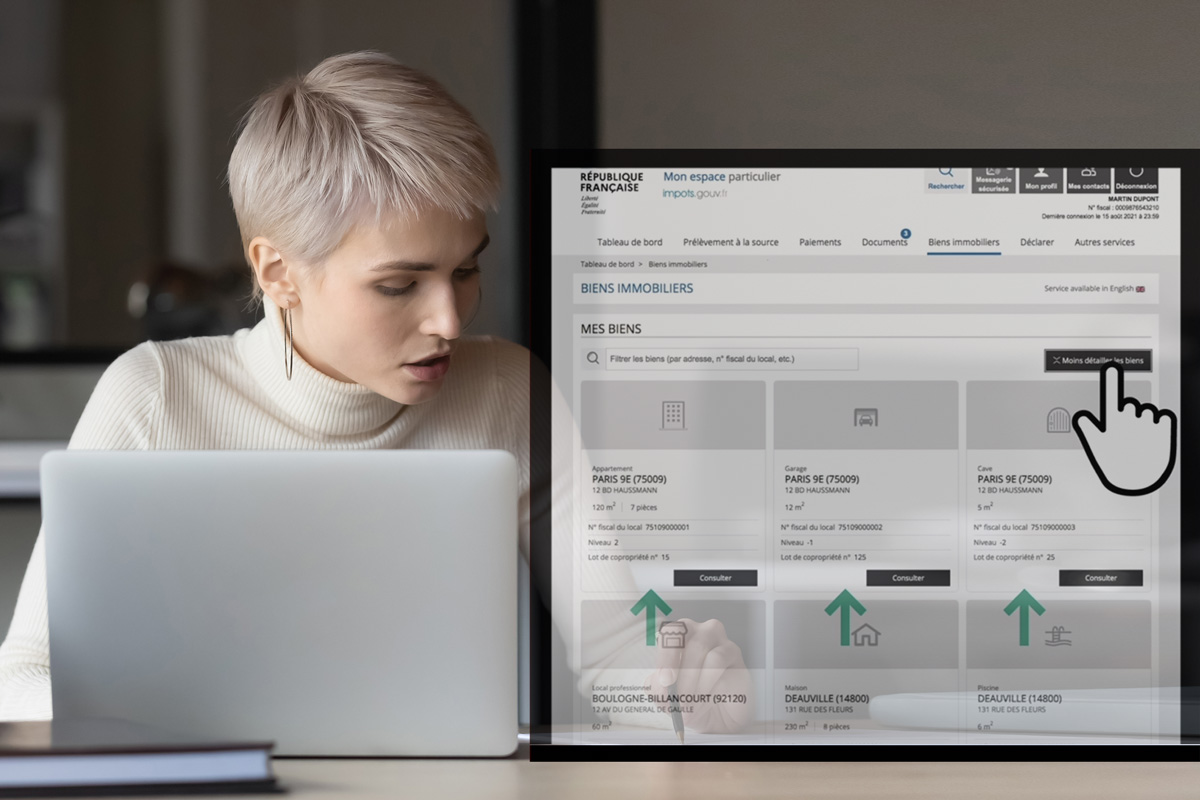

Non-residents who earn rentals income from a property they own in France are liable in France to pay income tax on the net proceeds of that activity. In practice, a minimum imposition of 20% applies.

Most non-residents benefit from a double taxation treaty, which grants partial relief against liability to tax in their home country, however it implies that they need to declare rental income to both the French and their home country tax authorities. Non-residents in France will include in their French tax declaration a copy of the tax notice from their home country for the relevant year.

I regularly encounter foreign clients who believe their rental income from a property owned in France only needs to be declared in their home country. Not only does this imply that they might lose some deduction and rebate, but it also generates an administrative risk in regard of French tax failure to declare these incomes.

My work in helping such clients and advising them on the best routes to take to mediate the issue is done with great personal pleasure.

Coupling this with the fact that I am bilingual in English and French allows for a relationship without misunderstanding. I am proud to build bridges with foreign legal cultures and assist foreigners in understanding how French tax works.

Should you like to receive advice on your own situation, please do not hesitate to contact me. My first stage of advice is often free of charge and I will be happy to counsel you with the relevant

information so that you can enjoy your investments in the region with the calm and serenity that inspires the azure sky of the French Riviera.