Homeowners in France: should you pay the 3% tax?

All legal entities that — directly, indirectly or through an intermediary entity — hold one or more properties situated in France must pay an annual tax equal to 3% of the property market value. This applies to entities such as French and Monaco SCIs as well as entities like trusts and fiduciaries of all kind and jurisdiction, and mainstream entities such as an English LLC, a German Gmbh or a Luxembourgian Soparfi.

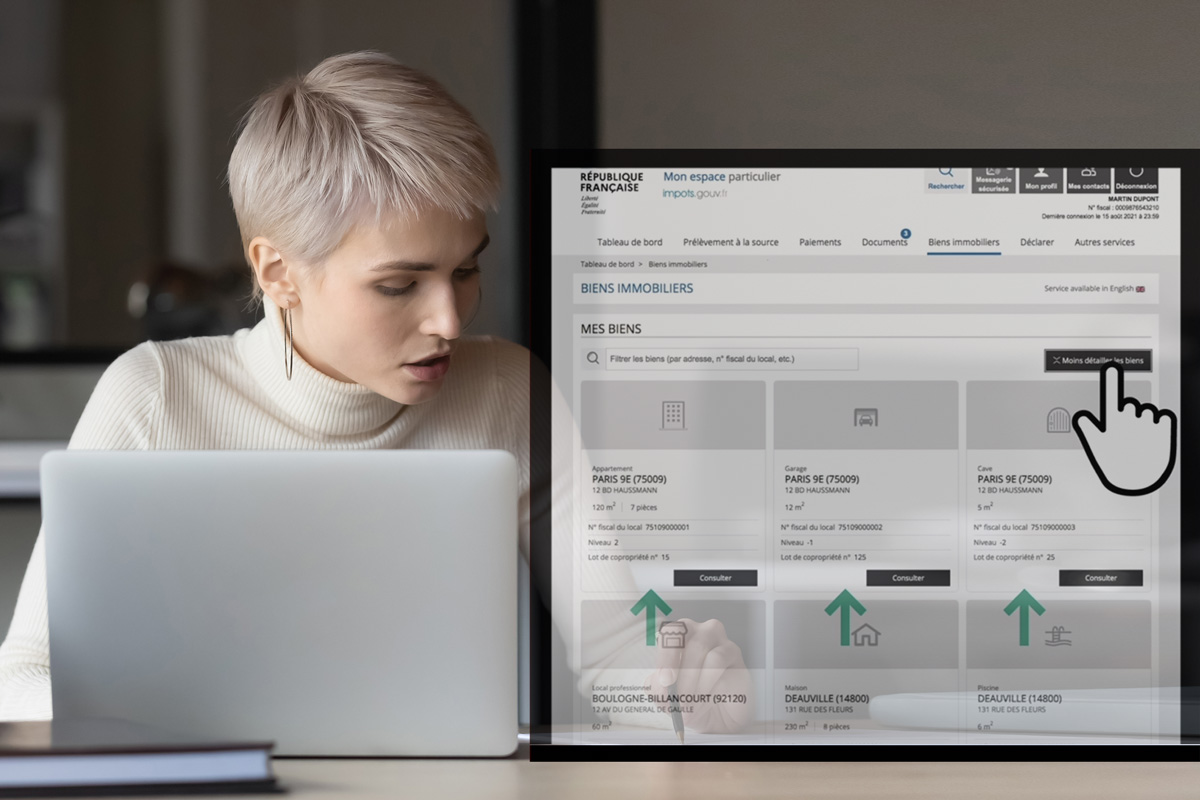

The legal entities concerned must complete and submit the form N°2746 (which contains all the following required information: location, description and value of the properties owned as of January 1st, names and addresses of all shareholders, and the number of shares held by each of them) to the French Tax Authorities (Service des Impôts des Entreprises) by May 16th each year. It is only in providing such information that those entities will not be taxable. Failure to comply with the obligation will activate the payment of the tax and penalties will be applied. I regularly encounter foreign clients who are overwhelmed by the situation and ask me for advice because the Tax Administration called for retrospective payments going back six years for the 3% tax. What I do for them, with great pleasure, allows a relationship without misunderstanding.

I am bilingual in English and French, and am proud to build bridges with foreign legal cultures and assist foreigners in understanding how French tax works. Should you wish to receive advice on your situation or determine if you are taxable in France and to what extent, please do not hesitate to contact me. My first advice is often free of charge and I will be happy to counsel you with the relevant information so that you can enjoy your vacation on the Riviera with the calm and serenity that inspires the azure sky of the French Riviera.