French wealth tax for non residents to be applicable for assets above 2,7 millions euros.

Do you hold assets in France for a value above 2,7 millions euros ? If so, you would be well advised to read on :

Download the PDF DOCUMENT : WEALTH TAX DECLARATION 2725 FOR ASSETS ABOVE 2,7 MILLIONS EUROS

Download the PDF DOCUMENT : WEALTH TAX GUIDE FOR ASSETS ABOVE 2,7 MILLIONS EUROS

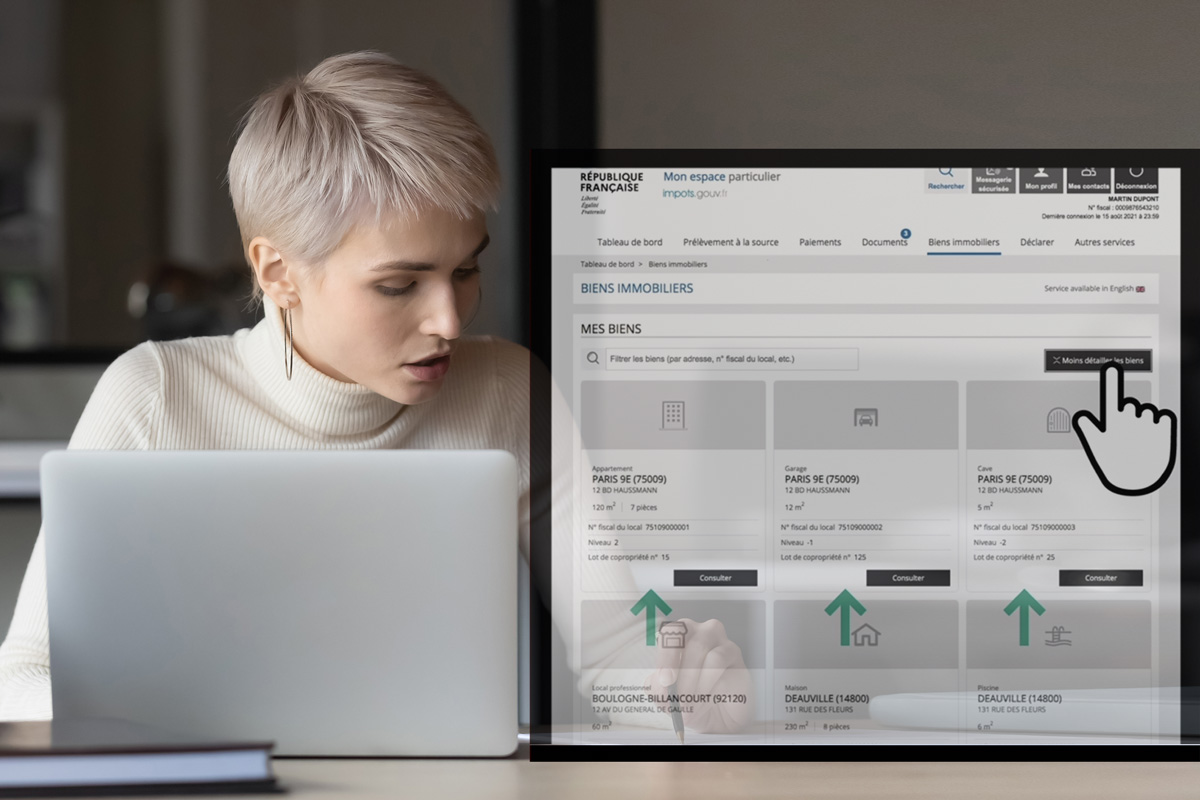

It is reminded that wealth tax declarations must be sent to the tax centre for non residents in NOISY LE GRAND each year and before July 15th.